There have been signs of progress towards cutting down the backlog of containerships stacked outside ports, but now it appears the trend is reversing.

There is growing congestion at other ports around the globe as a result of the lockdowns in the major Chinese ports. One-fifth of the world’s containerships are stuck in ports due to congestion, according to a study released by Windward, an AI company.

In addition, they estimate that about a quarter of these ships are specifically left stranded at Chinese ports. It has been challenging for carriers to manage their schedules, which already demonstrate low reliability. According to numerous reports, more and more containerships are diverting away from Shanghai, but that is adding to the delays at other ports like Ningbo-Zhoushan due to the additional volumes, and carriers are resorting to blank sailings to cope.

Shanghai has been on lockdown since the end of March, and these increases correspond with it. Sea-Intelligence revealed that schedule reliability had improved for the first time in two years shortly before that. Although two-thirds of all containerships were still behind schedule in February 2022, Sea-Intelligence’s Global Liner Performance report showed that reliability had returned to levels not seen since mid-2021. The report stated that the number of days on which vessels were behind schedule, although still high, had also improved.

Windward’s Maritime AI platform released data extracted for its Maritime AI platform on April 19 which suggests that China’s lockdowns are significantly impacting the congestion outside the country’s ports. In February, there were 195 per cent fewer container ships awaiting outside Chinese ports today.”

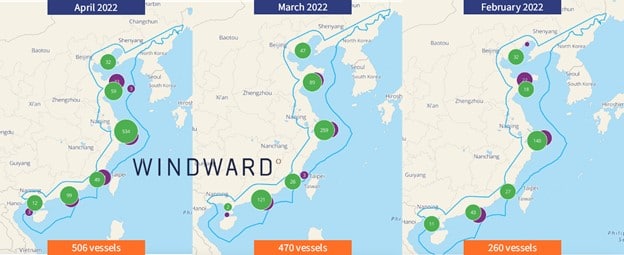

The analysis is illustrated by three images, each showing container vessels waiting outside China’s ports for 48 hours. As compared to February, when there were no lockdowns in China, to March, when Shenzhen was in lockdown, and now April, with the lockdown reaching Shanghai, a city with 25 million people and the busiest container port on the planet.

“It is clear that the trend is clear. The Chinese ports were ill-served in the April and March snapshots, respectively. In February, only 260 ships were scheduled to dock. As a result of China’s lockdowns, the congestion outside its ports has nearly doubled,” states Windward.

China insists the Shanghai port is open and operating normally. In an attempt to isolate port workers from the city and visitors, they used a closed-loop system in which they were placed inside a bubble. Truck traffic has been drastically reduced, for example, because trucks have been required to have negative COVID-19 tests in order to enter the port. Still, the virus has caused a shortage of workers in the ports.

Despite the fact that it might seem that other ports would be receiving relief from the huge number of vessels stuck off China, it appears that the opposite is taking place with schedules being disrupted for many of the major routes. Based on data provided by the Marine Exchange of Southern California, container vessels are again on the rise. A total of 33 containerships bound for Los Angeles and Long Beach departed California on April 4, just as lockdowns began in Shanghai.

Currently, there are 51 containerships waiting for service in Southern California, either near the coast or steaming toward the ports. Globally, there were 1,826 vessels waiting outside of ports between April 12-13, 2022, according to Windward. “That’s 20 per cent of all container vessels globally!”

As per Windward’s Maritime AI data, China is currently home to 506 ships waiting offshore, representing more than a quarter (27.7%) of all ships waiting outside of ports worldwide. China’s backlog of vessels stuck in port congestion in February was equivalent to about one-sixth (14.8 %) of the vessels stuck in port congestion worldwide.

Shanghai has begun to report some progress in containing the recent waves of the virus. There has been some easing of some restrictions by the health authorities permitting factories to resume work by using a closed-loop keeping workers onsite but it is unclear when the port will be able to resume normal operations. Even then, there is concern about an additional ripple effect around the world as shippers rush to move goods that have been stuck in the supply chain and carriers rush vessels to international ports in an effort to restore schedules.